Crypto for Peer-to-Peer Payments

I feel like among all the talk about Crypto’s power problem, NFTs and their long list of issues, and Sam Bankman-Fried with his FTX scam, a lot of people perceive crypto as a whole as some terrible force and equate it to rubbish. And I can understand where that frustration comes from. Crypto is currently ripe with money laundering schemes, darknet illicit sales, and all kinds of ponzi schemes, but it wasn’t always meant to be this way.

Originally, cryptocurrency was seen as an idealistic breakthrough—a tool to revolutionize how we exchange value in a digital world. It presented a way to bypass traditional financial systems with their inherent inefficiencies, control, and reliance on trust. But as time passed, the reality of its mass adoption has been a double-edged sword. In this post, I’ll reflect on where cryptocurrency started, its potential for peer-to-peer payments, and what it still promises despite its many misuses.

Payment Processors: A Hidden Tax on Transactions

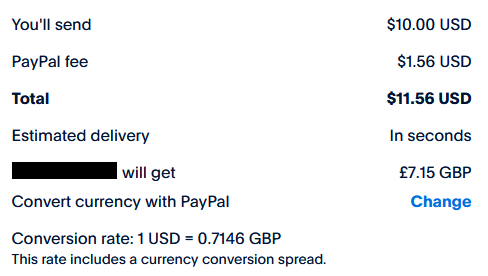

In the modern day and age, very few are unaware of the major payment processors that make the money flow—PayPal, Stripe, and Square, among others. These companies make their money by imposing a small fixed fee, a percentage fee, or both on every transaction they process on behalf of a user. Even card networks like Visa, Mastercard, Discover, and Amex take their cut. Every middle man takes a slice of the pie, until your transactions start to look like this:

We pay money, a lot of money, to pay people. This dynamic creates an almost hidden tax, one that most consumers simply accept as a necessary cost for the convenience of digital transactions. As cash becomes less and less common, with an increasing amount of businesses refusing cash, the world is starting to see the death of peer-to-peer tax-less payments. Especially in the digital realm, where cash can’t reign king, we’re left with very few mainstream ways of sending money to someone—whether for goods or services—without paying fees. Even holding your money costs money.

Decentralized & Cryptographic Financial Freedom

When the Bitcoin whitepaper was first released on the 31st of October 2008, it pitched a radically different world where people didn’t have to rely on intermediaries for monetary transfers but could instead rely on cryptographic proof. In the eyes of its author, the pseudonymous Satoshi Nakamoto, the internet was lacking any direct means of a user being able to transfer funds without having to rely on fallible, greedy, and sometimes knowingly malicious third-party payment processors.

”What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.” Nakamoto, Satoshi. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Section 1, Paragraph 2

Satoshi’s vision was for a decentralized future where people could transact globally without the constant siphoning of fees, without censorship, and without the risk of having money locked up by an unaccountable entity. Bitcoin was to be the digital equivalent of cash: a transaction between two parties that no one else could interfere with.

In this model, anyone with access to the internet could participate in the global economy, regardless of geography, wealth, or political boundaries. This promise is upheld today, as the core code for Bitcoin has been open source since 2009 allowing us, the users, to audit every line of code, establish our own trust in the system, and, if necessary, even make changes to it.

The Scams, Schemes, and Ponzi Coins

But with this power came an inevitable wave of opportunism. Satoshi’s optimistic future didn’t come to pass without catches. Blockchains that implemented smart contracts soon found themselves hosting scams, frauds, and schemes. The most prominent blockchain for smart contracts, Ethereum, became notorious for its glut of useless NFTs, speculative tokens, and elaborate Ponzi schemes.

While Bitcoin and other cryptos still offer the potential for direct peer-to-peer payments, the ecosystem has been tainted by actors more interested in get-rich-quick schemes than a genuine financial revolution. From rug pulls to pump-and-dump schemes, cryptocurrency today has earned its tarnished reputation.

Ever Enduring Peer-to-Peer Payments

Yet, despite the noise and corruption, at their core, cryptocurrencies still allow what Satoshi envisioned—interference-free, censorship-resistant, peer-to-peer payments. When used correctly, with the proper understanding and caution, paying someone with crypto can be a seamless and private experience, preserving the same qualities that make cash valuable: anonymity, control, and freedom.

Unlike traditional systems, where intermediaries have the power to freeze accounts, reverse transactions, or impose arbitrary fees, crypto transactions are immutable once confirmed. This permanence can be daunting but also liberating for those seeking more control over their financial lives.

By embracing cryptocurrency’s original ideals, we can start to detach from the mess it has become and instead leverage its strengths for simple, direct payments. In a world where privacy is constantly under threat, and financial systems seem to tighten their grip on individuals, crypto presents a rare opportunity to step outside that control.

The purpose of writing and publishing this blog post isn’t to pronounce my love for cryptocurrency or advocate for its adoption. It’s to serve as a disclosure for those who may see that my website accepts crypto tips and who may get hastily angry at the idea that someone like me might use cryptocurrencies. It’s to serve as a demonstration of my philosophical alignment in the space and the means for which I use it.